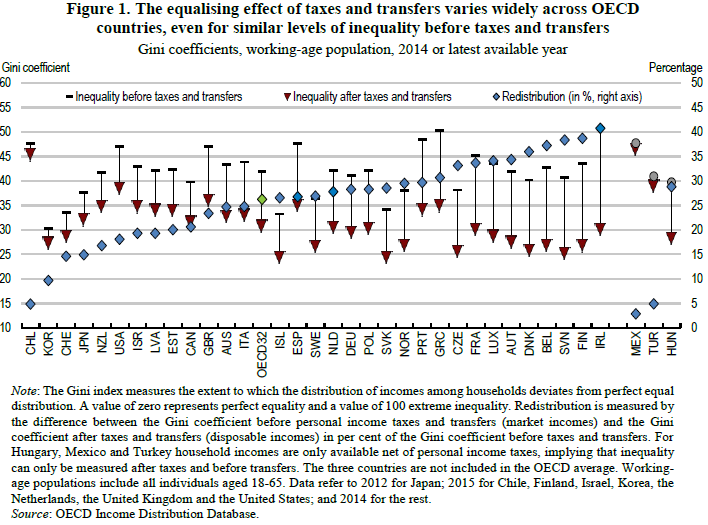

Income redistribution through taxes and transfers across OECD countries EU – Social Protection Reform Project, October 16 Rome Orsetta Causa, Senior. - ppt download

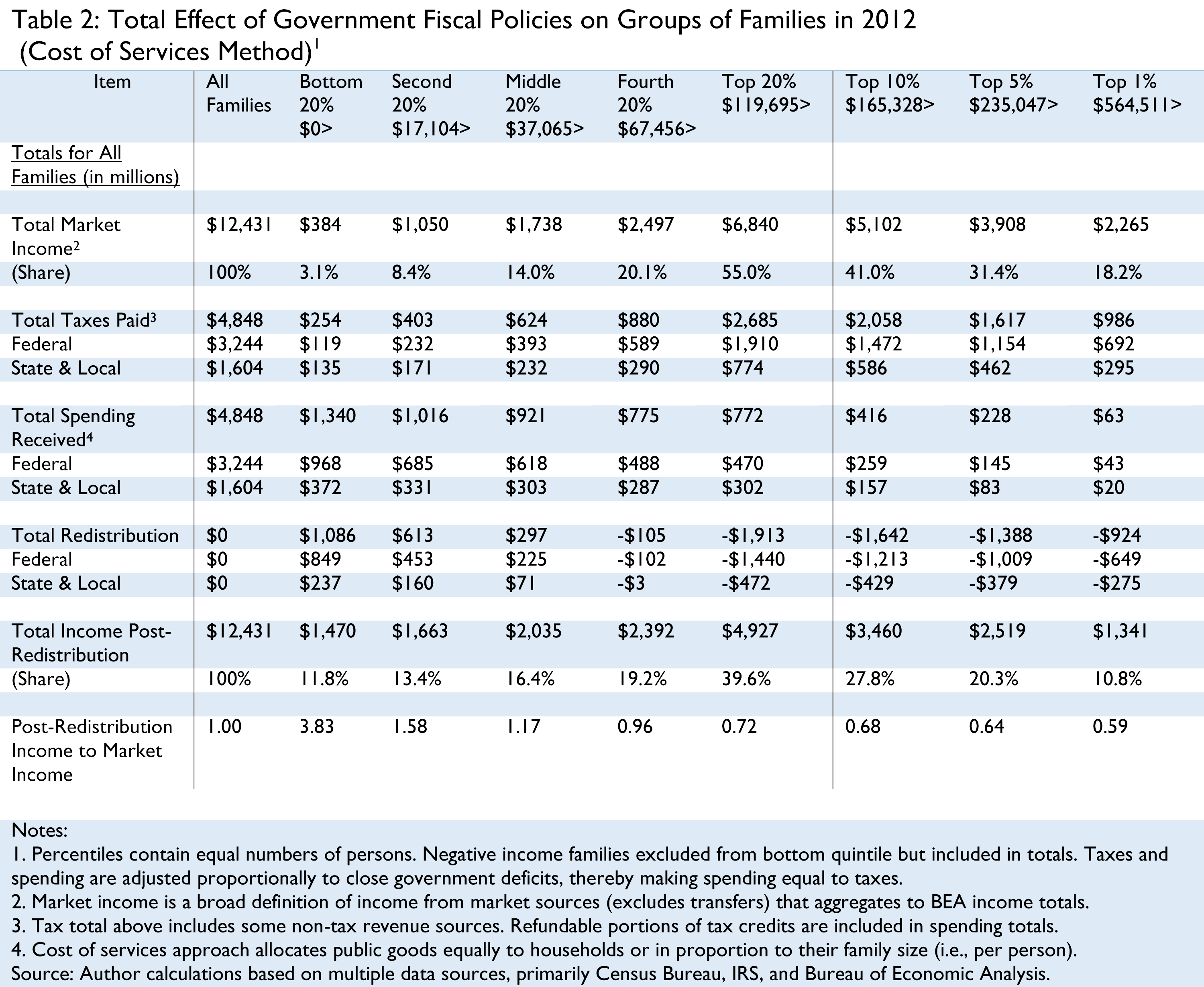

![PDF] How Redistributive Policies Reduce Market Inequality: Education Premiums in 22 OECD Countries | Semantic Scholar PDF] How Redistributive Policies Reduce Market Inequality: Education Premiums in 22 OECD Countries | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/0170f017b706eb53028a4c6157e54cb0e25d6d98/27-Table2-1.png)

PDF] How Redistributive Policies Reduce Market Inequality: Education Premiums in 22 OECD Countries | Semantic Scholar

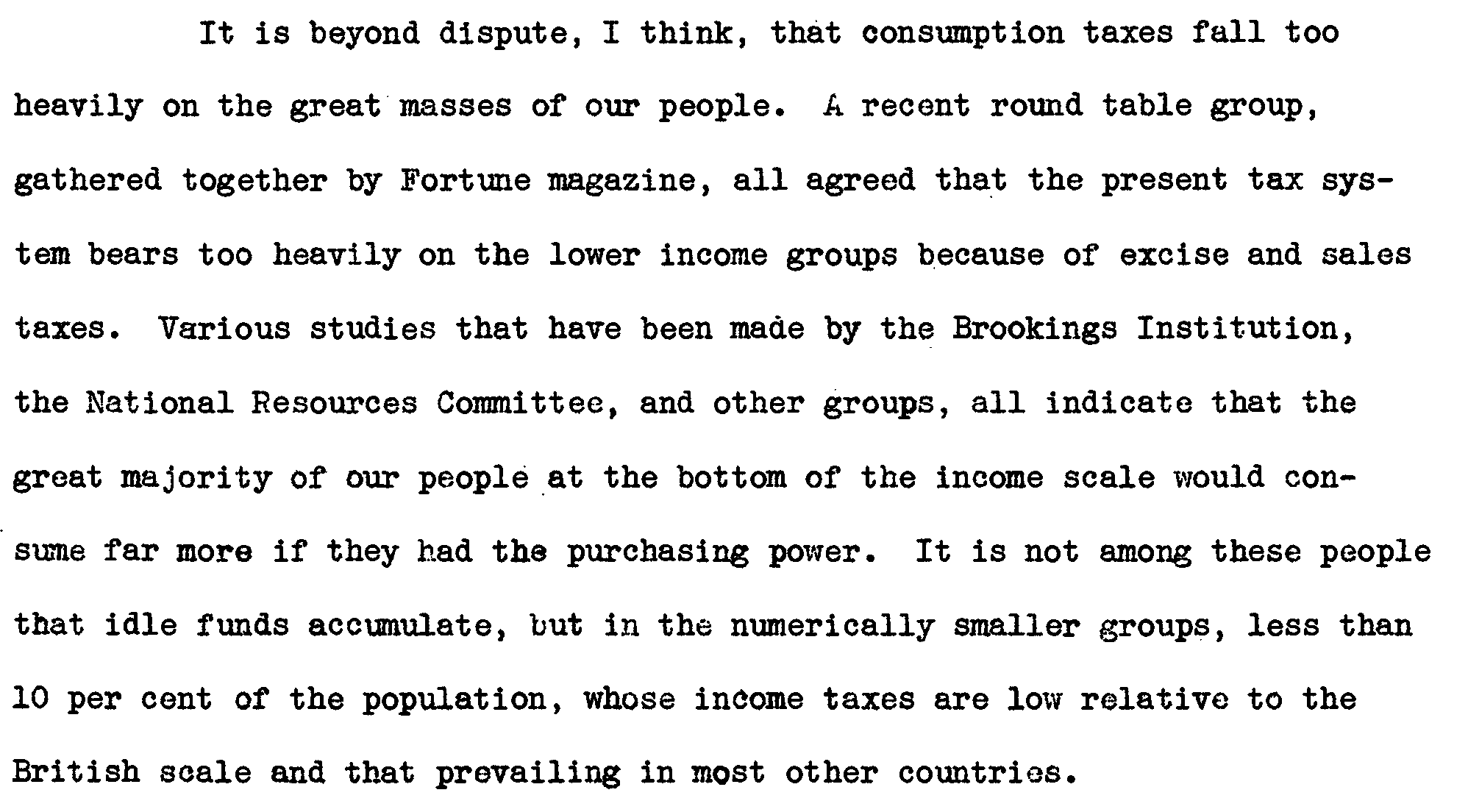

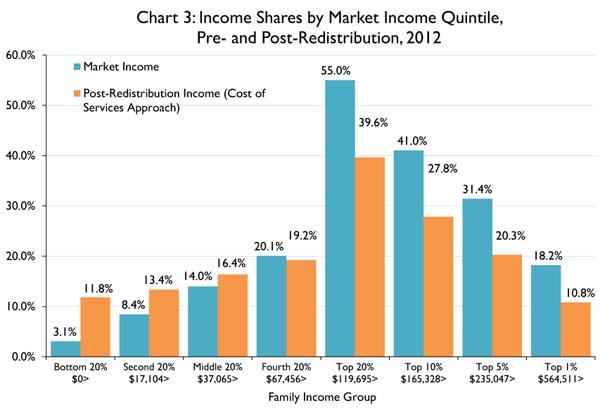

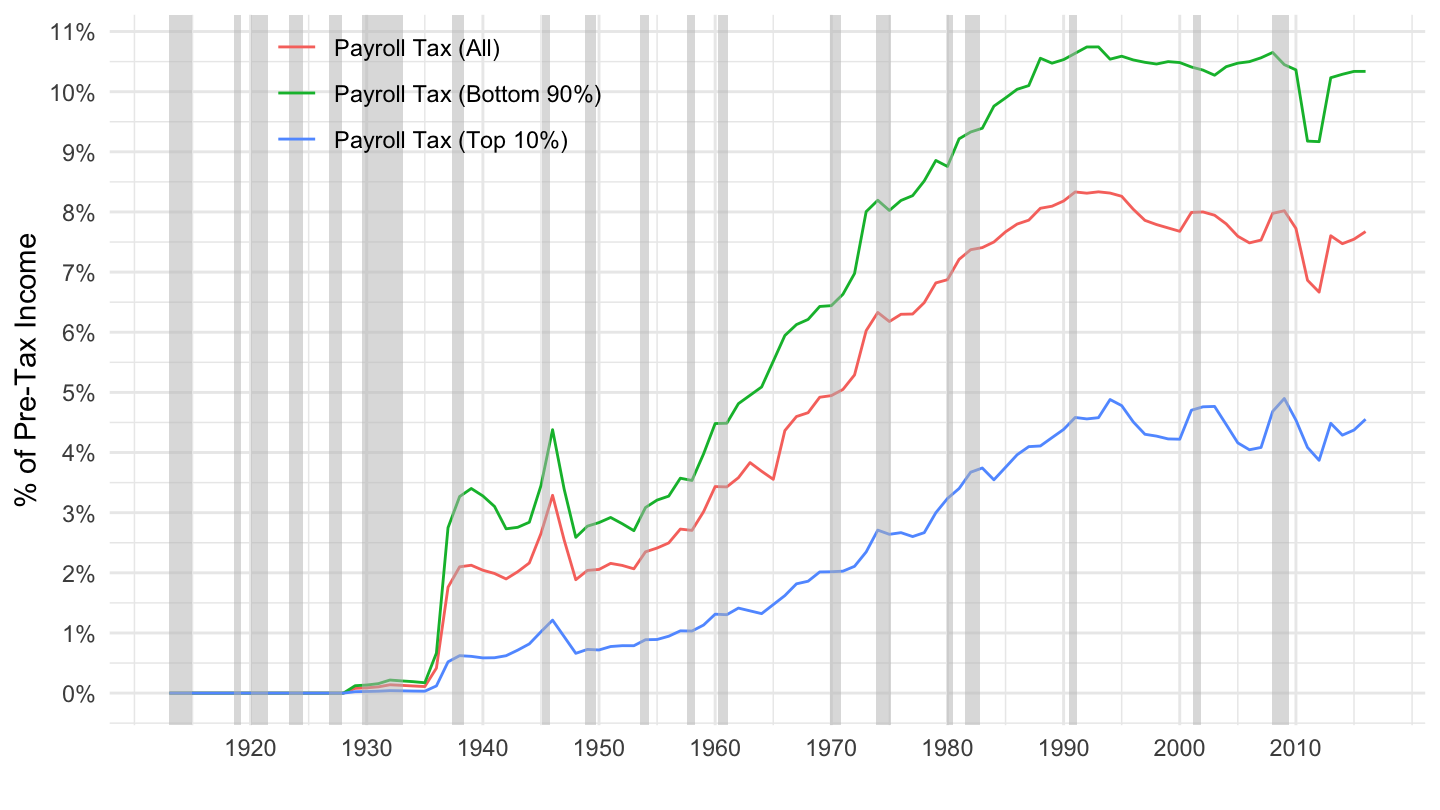

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014